Because there is an unlimited number of users that can use the program, you can maximize its use if you have a team of professionals who need access to your accounting software. For Xero’s Early plan ($13), the number of invoices that users can send each month is capped at 20, but for all other Xero plans, users can send unlimited invoices. Small businesses that are growing may want to use QuickBooks Essentials.

QuickBooks Online Basics: At a Glance

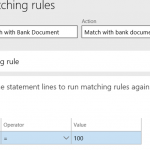

Alternatively, QuickBooks price levels can also be accessed from the “edit item record” function. Once you have successfully turned on the QuickBooks price levels setting, you’re ready to create a price rule. While it says “Beta” next to price rules, you don’t need to be concerned — the price levels function works great as-is.

QuickBooks Online Advanced plan

Note the default sales rate of $100 and the $75 rate due to the price rule (called “Beyond the Basics” in this instance). From here, you can name the price rule and select a start and end date https://www.business-accounting.net/small-business-guide-to-building-the-balance-sheet/ (if the promotion is only for a limited time). You can also create a price rule by navigating to the Products and Services list and then selecting the drop-down arrow next to the “More” tab.

QuickBooks Online Fees & Extra Costs

This includes inventory tracking, sales tracking, alerts for restocking inventory, and reports on the status of your inventory. QuickBooks eliminates bottlenecks with features like inventory tracking, purchase order management, and sales order fulfillment. QuickBooks has begun decreasing its desktop product offerings and encouraging businesses, where appropriate, to move to using one of its online products. For example, the QuickBooks Desktop Pro Plus plan is no longer available to new QuickBooks users. QuickBooks Self-Employed is a “lite” version of the Online product that’s ideal for people who earn income from a variety of sources and helps to separate personal and business finances. Customer support includes 24/7 help from a virtual assistant (chat bot) as well as live phone and chat support during daytime hours, Monday through Saturday.

(To give you an idea of how much this price fluctuates, one user on the Silver plan would cost $1,481/year, while 30 users would cost upwards of $9,729/year). Luckily, Intuit is often running promotions and discounts on the Intuit website. If you want the benefits of QuickBooks Premier Plus with QuickBooks Enhanced Payroll, sign up for the QuickBooks Premier Plus + Payroll plan.

These can be useful for companies with more complex business structures and accounting workflows. The Essentials plan costs $60 per month, supports three users, and brings a range of accounts payable functions to small businesses compared to the Simple Start plan. If you take part in the deal and skip the free plan, the first three months will only cost you $30 per month.

To get a discount on those rates of 1.6% to 3.3% plus 30 cents, you can pay a monthly $20 service fee. QuickBooks Enterprise has significantly fewer additional fees than QuickBooks Pro and Premier since many features are included with your annual subscription. In addition to the features offered by the Gold and Platinum plans, QuickBooks Enterprise Diamond adds Assisted Payroll and QuickBooks Time Elite. A Salesforce CRM Connector is available for this plan for an additional monthly fee and setup fee. QuickBooks Online offers four pricing plans that start at $30/month and cost up to $200/month, depending on the number of features and users your business needs.

I’d suggest providing feedback or submitting a feature request about being able to use the Prepayment feature even if Multicurrency is turned on. We love this title for its thoughtful tools that go beyond accounting to include what is depreciation time tracking, project management and client retention tools. It expertly solves the most common pain points involved in serving clients. When you’re ready to grow, you can seamlessly connect to other Zoho products.

- With a complex supply chain, comes complexity in other aspects of the business- accounting being a big one.

- When setting up an inventory item, you can choose the type of item you want to create, whether it’s an inventory part, noninventory part, or assembly.

- Using our free wholesale price calculator helps determine your benchmark pricing.

Wholesalers have specific inventory and order management requirements that need to be properly accounted for. QuickBooks Online accounting software is easy to set up, simple to use and comes with powerful and intuitive integrations https://www.personal-accounting.org/ to simplify even the most complex wholesale needs. If your business is service-based without any inventory, then Essentials should provide everything you need while saving you $30 per month compared to Plus.

If you report income on Schedule C of your personal income tax return, this cost-effective option might be best for you. Overall, QuickBooks Manufacturing and Wholesale edition provides necessary accounting tools but may not offer customized solutions that some manufacturers or wholesalers may need. For example, tracking inventory can be difficult as the system has limited capabilities compared to tailored industry solutions such as an enterprise resource planning system. Manufacturers and wholesalers have unique business processes that require industry-specific solutions. The QuickBooks for Manufacturing and Wholesale edition was created with that in mind.